Getting Started with Investing in Wholesaling

Real estate wholesaling investing offers newcomers a low-cost entry into property investment. The method requires finding distressed properties under contract and assigning purchase rights for a profit. By focusing on contract assignments rather than property ownership, wholesalers avoid large down payments and ongoing holding costs. This strategy develops expertise in property valuation, persuasive communication, and contract management. The fast deal cycles in wholesaling can accelerate cash flow compared to traditional buy-and-hold methods. Maintaining a vetted list of investors prepared to purchase contracts is essential for smooth assignments. Approaching wholesaling with diligence and ethical standards establishes credibility and sustainable growth.

Benefits of Investing in Wholesaling

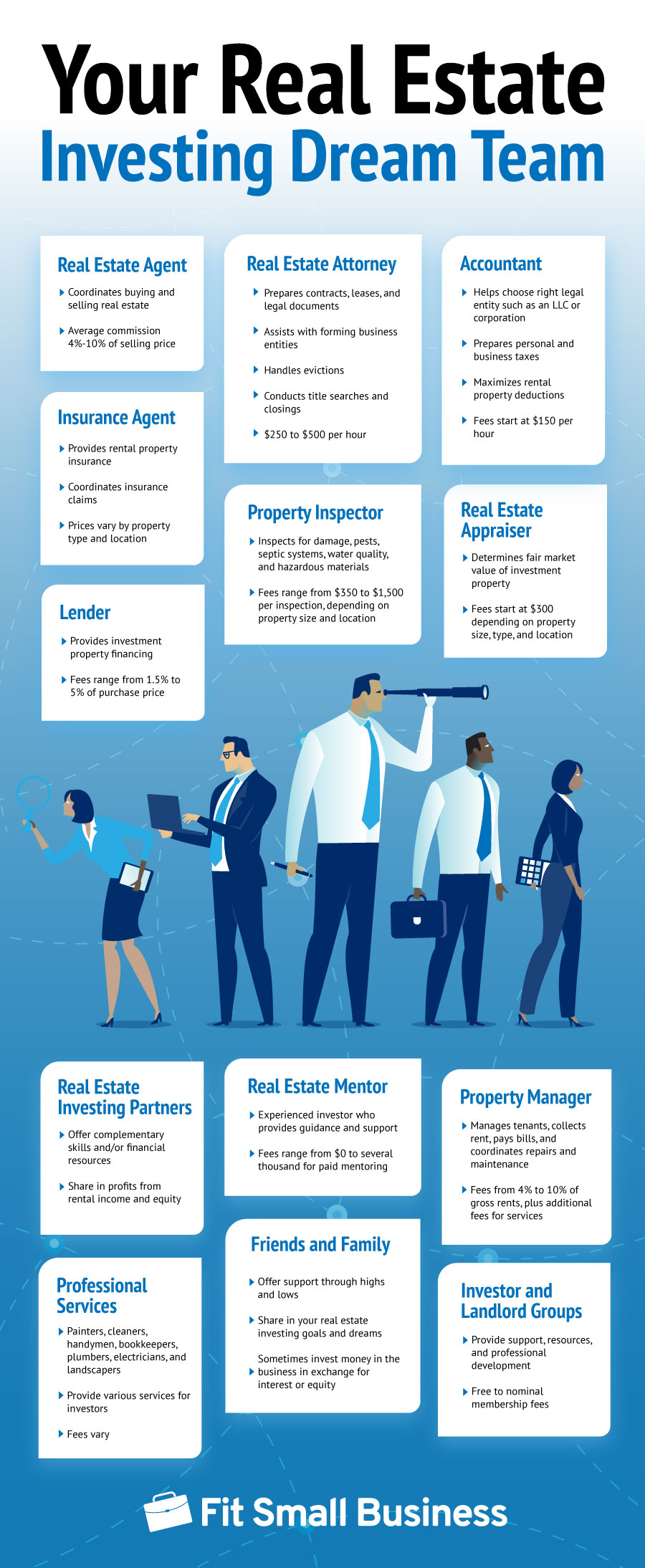

One significant benefit is the minimal capital required to start wholesaling, making it accessible to most investors. The quick closure of contracts enables faster realization of returns. Wholesaling teaches negotiation, deal evaluation, and network building useful across the property sector. This model eliminates the need for property upkeep and tenant relations. Wholesaling fosters relationship building with agents, attorneys, and investors, expanding professional networks.

Earnings from contract flips can fuel expansion into more significant opportunities. Predictable profits from contract transfers support sound budgeting and operational forecasting. Maintaining a contract-based approach keeps your funds free for new opportunities rather than tied up in mortgages. Taxes on single-event profits from contract assignments tend to be more straightforward than ongoing rental taxation. Joining experienced investor circles provides invaluable insights and exclusive lead sources. Digital marketing and CRM tools can further enhance lead generation and follow-up efficiency. Utilizing expert-led resources strengthens your wholesaling skills and industry awareness.

Discover more about investing in real estate wholesaling, visit: wholesale real estate investing

Tools & Resources for Wholesalers

An integrated CRM organizes contacts, tracks communications, and prompts timely outreach to each prospect. Digital lead solutions aggregate data on absentee owners and pre-foreclosures, giving you a head start on potential deals. Automated profit models compute key metrics like cap rate and cash-on-cash return to validate deals fast. Online signature services streamline legal paperwork, enabling remote closings without printing or scanning. Automated marketing platforms send drip campaigns that keep your name top-of-mind with motivated sellers. Secure closing portals let you monitor title searches, lien releases, and closing statements in one place. Online real estate communities and local meetups match you with active investors ready to close quickly.

When used in concert, these resources automate the majority of your workload, freeing you to chase the best deals.

Getting Started: Actionable Steps for New Investors

Begin by educating yourself on local market dynamics—study recent sales, price trends, and neighborhood developments. Deploy a multi-channel approach—letters, social media, and local classifieds—to build your initial lead database. Prepare a standard purchase agreement that includes clear assignment rights, vetted by legal counsel. Practice your pitch and negotiation scripts with peers or mentors to refine your communication skills. Build your investor database through local meetups, LinkedIn outreach, and referrals from industry contacts. Automate lead responses and drip campaigns so that no prospect goes unattended. Execute your first wholesale contract, analyze performance data, and continuously improve your system.

Typical Mistakes in Wholesaling and Their Solutions

Relying on a single comparable sale risks inaccurate valuations—cross-check with at least three nearby sales. Ignoring renovation budgets can turn a profitable contract into a loss—obtain accurate repair quotes upfront. Failing to build a robust buyer’s list can leave contracts stranded—continually grow and update your investor network. Poor follow-up habits result in lost leads—implement automated reminders to maintain consistent communication. Neglecting legal review of your contract templates can expose you to risk—always consult a real estate attorney. Taking on excessive contracts without proper systems in place increases errors—grow your pipeline in manageable stages. Ignoring market shifts and economic indicators can render your strategies obsolete—stay informed and adapt accordingly.

Conclusion and Next Steps

Real estate wholesaling offers a practical, low-risk avenue for new investors to generate income and build expertise. Honing expertise in identifying opportunities, calculating profits, and closing assignments sets you apart in the market. Leveraging the right tools—CRM, analytics platforms, and automated marketing—transforms complex workflows into efficient systems. Committed self-improvement, integrity, and strategic partnerships ensure lasting success in wholesaling. Start small, iterate quickly, and reinvest your profits to scale up your operations over time. With persistence and strategic execution, investing in real estate wholesaling can become a cornerstone of your real estate portfolio.

Embrace the journey, leverage the resources at wholesale real estate for beginners, and watch your wholesaling success unfold.